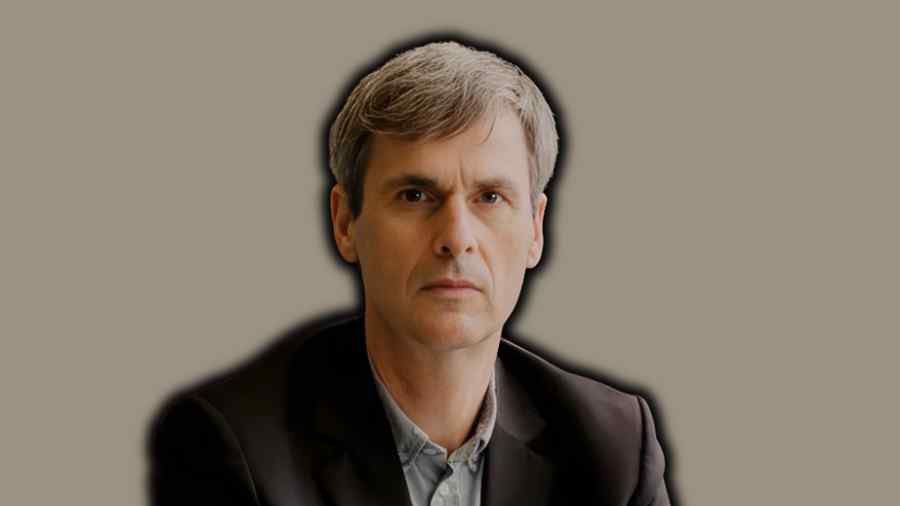

Jim Leaviss is a name that resonates strongly across the global bond markets and fixed income communities. Over nearly three decades, he built a reputation not only as a top-tier portfolio manager but also as a communicator who made bond investing accessible and engaging. Under his leadership, M&G’s fixed income division expanded from a small team into a global powerhouse. Now, as he steps away from that role to pursue personal passions, his legacy offers valuable lessons for investors, fund managers, and financial enthusiasts alike.

Table of Contents

ToggleEarly Career and Entry into Fixed Income

From the Bank of England to M&G Investments

Before joining M&G, Jim Leaviss began his career at the Bank of England as a gilt market analyst and dealer. This experience gave him deep insights into government bond markets, interest rate mechanics, and monetary policy. These skills became the foundation of his future success.

In 1997, he moved to M&G Investments, one of the UK’s most respected asset management firms. At that time, M&G’s fixed income team was small and relatively underdeveloped. However, Leaviss saw immense potential in growing the bond management side of the business, especially as global demand for income products started to rise in the late 1990s.

Building the Team and Expanding the Vision

When Jim Leaviss joined M&G, the fixed income department consisted of only a few professionals. Over the years, under his guidance, it grew into a large, globally recognised team with expertise across multiple fixed income sectors. He believed in building a strong research-driven culture, hiring skilled analysts, and fostering collaboration across regions including London, Paris, and Singapore.

Through his leadership, M&G became a significant force in government bonds, corporate debt, emerging market debt, and flexible bond strategies. His approach combined disciplined research, macroeconomic understanding, and a commitment to long-term value creation.

Rise to Leadership: The Journey to CIO

Becoming Chief Investment Officer

Jim Leaviss’s consistent performance, leadership, and vision led him to the position of Chief Investment Officer (CIO) for Public Fixed Income at M&G. In this role, he was responsible for overseeing bond strategies that managed billions in assets across the world. His focus on macroeconomic cycles, credit markets, and risk management positioned M&G as one of the most respected names in fixed income.

Communicating with Investors: The Birth of “Bond Vigilantes”

In 2006, Leaviss launched the “Bond Vigilantes” blog. It became one of the most influential platforms for discussing global bond markets. Through this initiative, he aimed to make fixed income topics understandable for a broader audience. His commentary on inflation, interest rates, and market cycles was known for its clarity and depth.

He later introduced a podcast titled “Uncle Jim’s World of Bonds,” where he discussed trends in the bond markets in a conversational tone. These platforms helped educate investors and gave M&G a human face in an industry often viewed as overly complex or technical.

Investment Philosophy and Market Insights

Focus on Risk Management

One of the strongest pillars of Jim Leaviss’s philosophy has been risk management. He often emphasised that success in bond investing is not about taking big bets but about avoiding large mistakes. During volatile times such as the global financial crisis and the COVID-19 pandemic, he advocated for reducing risk exposure, preserving capital, and maintaining flexibility.

He believed that protecting the downside is as important as capturing returns during bullish cycles. This approach helped M&G’s fixed income funds maintain stability during market turbulence.

Macro-Aware and Value-Driven

Leaviss’s investment decisions combined macroeconomic awareness with selective credit exposure. He preferred a balanced approach, mixing high-quality government bonds with carefully chosen corporate bonds. He often adjusted portfolios based on central bank policy expectations, inflation trends, and credit cycle phases.

His strategies reflected patience and discipline. Rather than chasing short-term gains, he focused on long-term value and consistent compounding of returns.

Transparent Communication and Investor Education

Unlike many fund managers who remain behind the scenes, Leaviss made it a priority to communicate directly with clients and the public. His plain-language explanations of interest rate policies, yield curves, and global debt markets helped ordinary investors understand complex topics. This transparency built trust and set a standard for the industry.

Achievements and Contributions

Transforming M&G’s Fixed Income Division

Under Leaviss’s leadership, M&G’s fixed income division grew its assets under management significantly. He was instrumental in launching several key bond funds, including the Global Macro Bond Fund and other flexible bond strategies that offered investors access to diverse markets.

He was also central to creating a culture of research and collaboration. Many analysts and portfolio managers who trained under him went on to become leaders in their own right. His ability to inspire talent and create a strong internal culture is often cited as one of his greatest achievements.

Innovation and Public Engagement

The Bond Vigilantes platform became a model for how asset managers could engage with clients and the public. It allowed M&G to present its thought leadership and market analysis in a way that was both authoritative and relatable. Leaviss’s voice became synonymous with informed, grounded commentary on global bond issues.

The Turning Point: Departure from M&G

A Career Shift After 27 Years

In 2024, after nearly three decades at M&G, Jim Leaviss announced that he would be leaving to pursue a new personal journey — studying for a master’s degree in the History of Art. This marked the end of an era for M&G’s fixed income business and the beginning of a new chapter for one of the most respected figures in finance.

His decision to step away was driven by curiosity and a lifelong interest in art and culture. Rather than continuing in the same professional cycle, he chose to explore creativity, history, and aesthetics — demonstrating that intellectual growth and reinvention are always possible, even after a long and successful career.

Industry Reaction and Transition

The financial industry responded to his departure with admiration and respect. Many peers described him as one of the most thoughtful leaders in fixed income, known for balancing intellect, discipline, and communication. M&G announced that a new leadership team would take over the fixed income division, ensuring continuity of strategy while introducing fresh perspectives.

Lessons from Jim Leaviss’s Career

Communication Builds Trust

Leaviss understood that clear communication can build confidence among investors. His approachable explanations turned complicated subjects into understandable concepts. This communication-first strategy helped establish strong client loyalty and industry credibility.

Prepare for Downturns

He repeatedly advised investors to be cautious during good times and to prepare for difficult ones. His ability to anticipate market shifts and position portfolios defensively protected investors from significant losses during market stress.

Integrate Macro and Micro Analysis

Leaviss believed that successful bond investing requires both a top-down understanding of global economics and a bottom-up view of individual securities. This dual perspective allowed his strategies to remain resilient in changing environments.

Lead Through Mentorship

Throughout his career, Leaviss mentored many professionals who would go on to lead in the investment world. His ability to share knowledge, guide young analysts, and encourage intellectual curiosity created a lasting legacy inside M&G and across the broader asset management community.

Balance Ambition with Personal Fulfilment

By deciding to leave finance to study art, Leaviss reminded the world that professional success is not the only measure of achievement. Pursuing personal passions can be equally valuable, especially after years of dedication to a demanding career.

Legacy and Future Influence

Shaping the Future of Bond Management

Jim Leaviss’s influence on M&G and the wider bond community will be long-lasting. His combination of expertise, humility, and clear communication has set a benchmark for how modern portfolio managers should operate. The strategies and frameworks he built continue to guide M&G’s investment decisions even after his departure.

Inspiring a New Generation of Investors

Younger investors and fund managers continue to learn from his writings and commentaries. His willingness to engage, explain, and educate has inspired a culture of openness in a sector that was once seen as closed and technical.

Beyond Finance: The Human Side of Success

Leaviss’s decision to pursue art demonstrates the value of lifelong curiosity. It shows that analytical minds can also appreciate creativity, and that intellectual versatility leads to deeper understanding — whether in markets or in art history.

Conclusion

Jim Leaviss is more than just a successful investor; he is a thinker, a teacher, and a pioneer in making bond markets understandable. From his early days at the Bank of England to his leadership role at M&G, he consistently proved that discipline, education, and communication are the cornerstones of long-term success. His transition to a new field symbolises the courage to evolve beyond comfort zones.

His legacy will remain a guiding example for those in finance and beyond — a reminder that true leadership lies not only in managing money but in inspiring minds.