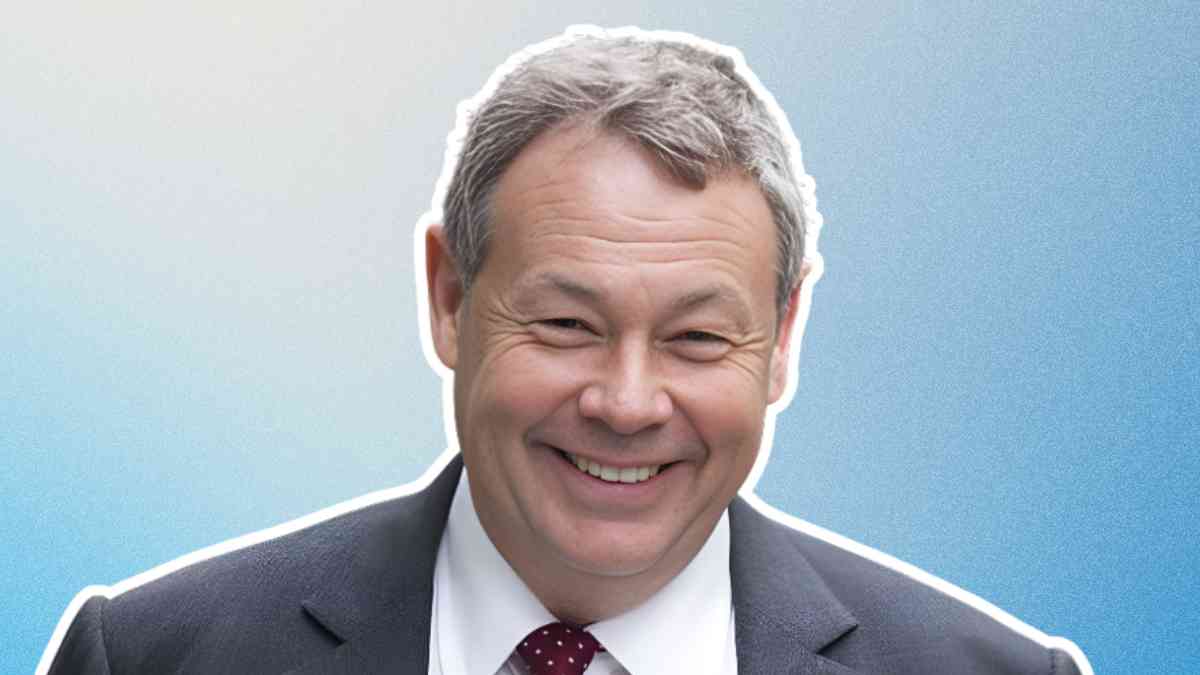

Ian Hannam: The Dealmaker Behind Britain’s Biggest Mining and Energy Transactions

Ian Hannam is a name that commands respect and intrigue across the global financial community. Known widely as the “King of Mining,” Hannam carved out an influential niche in the high-stakes world of investment banking, particularly within the mining and natural resources sector. From his early days in the military to orchestrating multi-billion-dollar deals, his story is one of ambition, strategy, controversy, and enduring influence.

Early Life and Education

Born in March 1956 in South London, Ian Hannam’s early life was rooted in modest beginnings. His academic prowess and tenacity led him to pursue higher education at Imperial College London, where he earned a degree in Engineering. Later, he advanced his business acumen with an MSc in Economics from the London Business School.

This strong technical and economic foundation would later prove critical in his understanding of complex financial instruments, infrastructure projects, and the capital-intensive nature of mining and energy sectors.

Military Service: A Foundation of Discipline

Before entering the financial world, Hannam served in the 21 SAS Artists Regiment, a special forces unit within the British Army Reserve. Rising to the rank of Captain, he was known for his strategic thinking and leadership under pressure. This experience left a lasting impression, shaping his direct communication style and decisive deal-making approach in banking.

Many of his colleagues have noted that his military background gave him an unmatched resilience and a unique perspective on risk — assets that proved invaluable in the high-volatility world of mergers and acquisitions.

Rise in Investment Banking: From Salomon Brothers to JPMorgan

Hannam began his finance career in 1984 with Salomon Brothers, where he played a pivotal role in major UK privatisations. These included high-profile public offerings such as British Telecom, British Airways, and BP — moves that helped lay the groundwork for the Thatcher government’s economic reforms.

His transition to Robert Fleming & Co. in 1992 further expanded his global reach. Here, he was involved in significant capital market deals, including the world’s largest equity offering at the time involving Wellcome Trust’s holdings.

But it was his tenure at JPMorgan from 2000 to 2012 that truly defined his reputation. As Vice Chairman of Capital Markets and later a key architect of JPMorgan’s Natural Resources franchise, Hannam advised on deals involving some of the largest players in mining: Xstrata, BHP Billiton, Rio Tinto, and SABMiller. His understanding of both the financial mechanics and the operational intricacies of mining operations gave him an edge over competitors.

The “King of Mining”: Hannam’s Signature Deals

The moniker “King of Mining” was not handed out lightly. Hannam’s deal history reads like a directory of the world’s most valuable resource companies. His ability to bridge boardroom politics with geopolitical considerations made him a sought-after advisor in the mining sector, especially in resource-rich but politically complex regions like Africa and Latin America.

Some landmark deals under his leadership include:

- Advising Xstrata on its controversial merger with Glencore, creating one of the largest mining entities globally.

- Structuring financing for Kazakhmys, one of the largest copper producers in Kazakhstan.

- Advising Vedanta Resources in its acquisition of oil assets from Cairn India.

These deals often involved navigating multiple jurisdictions, regulatory hurdles, and strategic diplomacy — skills Hannam honed over decades.

Regulatory Controversy: The FCA Fine

In 2012, Ian Hannam’s career took a hit when the UK’s Financial Conduct Authority (FCA) fined him £450,000 for “market abuse.” The case stemmed from emails he had sent in 2008 while advising Heritage Oil, which the FCA claimed contained insider information shared without proper authorization.

Hannam denied any wrongdoing, insisting that the emails were part of normal client communication. Despite an appeal, the decision was upheld in 2014, forcing him to step down from JPMorgan.

While the incident tarnished his public image to some extent, it did little to erode his influence among peers and within the natural resources sector. Supporters argued that the penalty was disproportionate and pointed to Hannam’s clean track record across hundreds of transactions.

A New Chapter: Hannam & Partners

Following his departure from JPMorgan, Hannam founded Hannam & Partners, a boutique investment firm based in London. The firm has quickly earned a reputation for delivering high-impact advisory services across mining, energy, infrastructure, and defense industries.

Unlike traditional investment banks, Hannam & Partners operates with a nimble, client-focused model. It provides tailored advice to companies looking to raise capital, merge, or expand their operations — often in frontier markets where deep domain expertise and strong networks are paramount.

Notable achievements of the firm include:

- Advising African mining firms on strategic partnerships.

- Securing critical infrastructure financing in Central Asia.

- Helping clients navigate global ESG (Environmental, Social, Governance) investment trends.

The Barrick Gold Dispute and Legal Vindication

In a more recent headline, Hannam & Partners sued Barrick Gold over unpaid fees tied to its Randgold merger, which Hannam claimed he facilitated through strategic introductions and groundwork.

Though there was no formal engagement letter, a UK court sided with Hannam, ordering Barrick to pay over $2 million on grounds of unjust enrichment. The ruling was not just a financial victory but a reaffirmation of his credibility as a serious dealmaker, even outside traditional banking frameworks.

Personal Investments and Broader Impact

Beyond corporate advisory, Ian Hannam has invested personally in various ventures. These include renewable energy, personal protective equipment (PPE) manufacturing, and financial technology startups. His diversified interests reflect a belief in long-term transformation across industries that are often overlooked by mainstream finance.

He is also active in supporting military charities and entrepreneurship programs, drawing on his background to mentor future leaders.

Ian Hannam’s Reputation and Legacy

Ask those who have worked with Ian Hannam, and the most frequent descriptors are “direct,” “strategic,” and “relentless.” His approach has not always been universally admired — some have criticized his aggressive style — but even critics acknowledge his results.

He brought Wall Street-style deal-making into the resource-rich, risk-laden world of global mining — and made it work. His continued relevance in today’s rapidly changing financial landscape is a testament to his adaptability and foresight.

Conclusion: A Figure of Influence, Controversy, and Longevity

Ian Hannam remains one of Britain’s most prominent and enigmatic financial figures. From commanding military units to leading billion-dollar negotiations, his career has spanned disciplines and continents. Despite facing regulatory scrutiny, he has re-emerged as a formidable player in finance through his boutique advisory firm and personal investments.

In a world where financial giants often fall silent after controversy, Hannam’s resurgence is not just unusual — it’s remarkable. His story serves as a powerful reminder that leadership, resilience, and sharp judgment continue to define success in global finance.