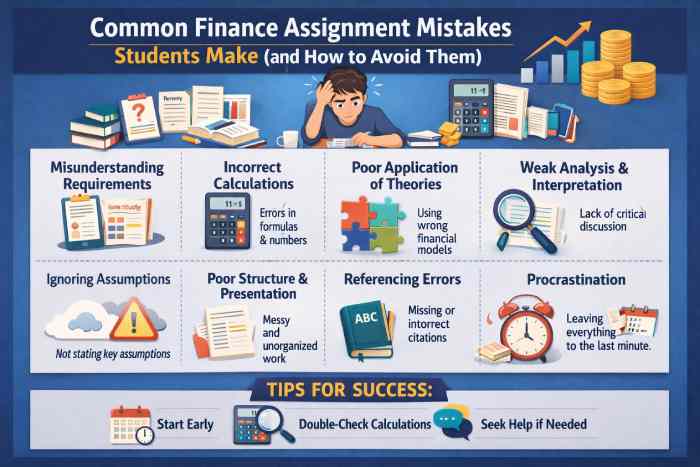

Common Finance Assignment Mistakes Students Make (and How to Avoid Them)

Finance is one of the most demanding subjects for university students. Unlike theoretical disciplines, finance assignments require a strong balance of conceptual understanding, numerical accuracy, analytical thinking, and proper academic presentation. Even small mistakes in calculations or assumptions can significantly impact grades.

Despite putting in long hours, many students continue to lose marks due to avoidable errors. Understanding these common finance assignment mistakes—and learning how to avoid them—can help students improve both their performance and confidence.

This article explores the most frequent issues students face in finance assignments and provides practical strategies to overcome them.

1. Misunderstanding the Assignment Requirements

One of the most common mistakes students make is rushing into calculations without fully understanding what the assignment is asking.

Finance assignments often include:

- Case study analysis

- Financial ratio evaluation

- Investment appraisal

- Risk assessment or forecasting

Students sometimes focus only on computations and ignore command words such as analyse, evaluate, compare, or justify. As a result, the submission may lack explanation, critical discussion, or strategic recommendations.

How to avoid it:

- Carefully read the assignment brief multiple times

- Identify key tasks, required models, and word allocation

- Clarify whether explanations, assumptions, or interpretations are required alongside calculations

If uncertainty persists, seeking structured academic assignment help can ensure that the assignment aligns with marking criteria from the beginning.

2. Incorrect or Incomplete Financial Calculations

Finance assignments are highly marks-sensitive when it comes to numerical accuracy. Common calculation errors include:

- Incorrect formulas

- Calculation rounding mistakes

- Errors in discount rates or time periods

- Incorrect handling of cash flows

Even when the approach is correct, a small numerical error can cascade into incorrect results.

How to avoid it:

- Double-check formulas before applying them

- Use financial calculators or spreadsheet tools carefully

- Cross-verify results with manual calculations

- Clearly show workings to gain partial marks

Accuracy is essential not just for grades, but also for developing real-world finance skills.

3. Poor Application of Financial Theories

Another frequent mistake is mentioning financial theories without properly applying them to the case or problem.

Students often:

- Define theories without linking them to the scenario

- Apply incorrect models to the given data

- Ignore assumptions behind financial frameworks

For example, using Net Present Value (NPV) without discussing discount rate assumptions weakens the analysis.

How to avoid it:

- Choose models relevant to the question

- Explain why a specific theory is appropriate

- Connect calculations directly to real-world financial decisions

Strong application demonstrates understanding beyond memorisation.

4. Weak Financial Analysis and Interpretation

Many finance assignments contain accurate calculations but lose marks due to weak interpretation.

Markers expect students to answer:

- What do the results mean?

- How do they affect decision-making?

- What are the risks and limitations?

Merely presenting numbers without analysis makes the assignment descriptive rather than analytical.

How to avoid it:

- Interpret each result in simple financial terms

- Discuss implications for investors, managers, or stakeholders

- Highlight risks, assumptions, and alternative outcomes

Professional finance assignment help often focuses heavily on strengthening analysis and interpretation—areas where students commonly struggle.

5. Ignoring Assumptions and Limitations

Finance models rely on assumptions such as stable interest rates, predictable cash flows, or efficient markets. Many students fail to acknowledge these assumptions.

This can make the analysis appear unrealistic or incomplete.

How to avoid it:

- Explicitly state assumptions used in calculations

- Explain how changes in assumptions could affect results

- Discuss limitations of financial models where relevant

Acknowledging limitations demonstrates critical thinking and academic maturity.

6. Poor Structure and Presentation

Finance assignments are not just about numbers; presentation matters.

Common presentation mistakes include:

- Unstructured paragraphs

- Missing headings or tables

- Poorly formatted calculations

- Lack of clarity in explanations

Even high-quality content can lose marks if it is difficult to follow.

How to avoid it:

- Use clear headings and subheadings

- Present calculations in tables or appendices

- Label graphs and figures correctly

- Maintain logical flow between sections

A well-structured assignment helps markers understand your work quickly and clearly.

7. Incorrect Referencing and Academic Integrity Issues

Finance assignments often require referencing textbooks, journal articles, or financial reports. Common referencing errors include:

- Missing citations

- Incorrect referencing style

- Over-reliance on unverified online sources

In serious cases, improper referencing can raise academic integrity concerns.

How to avoid it:

- Follow the required referencing style consistently

- Cite all data sources and theories

- Avoid copying financial models without explanation

Maintaining academic integrity is essential for long-term academic success.

8. Leaving Assignments Until the Last Minute

Finance assignments require time for:

- Understanding concepts

- Performing calculations

- Reviewing assumptions

- Proofreading

Last-minute submissions often contain avoidable errors and weak explanations.

How to avoid it:

- Start early and break tasks into stages

- Allocate time for review and corrections

- Seek feedback or clarification before deadlines

Planning ahead significantly improves quality and reduces stress.

Final Thoughts

Finance assignments demand more than just mathematical ability. Success depends on understanding requirements, applying theories correctly, interpreting results clearly, and presenting work professionally.

By avoiding common mistakes such as calculation errors, weak analysis, and poor structure, students can dramatically improve their academic performance. When challenges persist, seeking expert guidance can provide clarity, accuracy, and confidence.

Mastering finance assignments is not just about grades—it builds analytical skills that are valuable throughout academic and professional careers.